Not known Facts About Offshore Business Formation

Table of ContentsThe Greatest Guide To Offshore Business FormationOur Offshore Business Formation PDFsAll About Offshore Business FormationOffshore Business Formation Fundamentals ExplainedExcitement About Offshore Business FormationThe Offshore Business Formation PDFs

In addition, the business will certainly be needed to report its globally revenue on its house nation's tax return. The procedure of setting up an overseas company is much more complicated than developing a regular corporation.

Establishing up an offshore company does not provide any savings given that you still pay tax on your around the world earnings. If you intend to reduce your worldwide tax concern, you need to consider developing numerous firms rather than one overseas entity. Once you relocate cash out of an overseas place, you will certainly be responsible for that revenue in your house nation.

What Does Offshore Business Formation Do?

The trade-off is that offshore firms incur charges, prices, and also other cons. However, if you prepare to incorporate offshore, then you must understand about the pros and disadvantages of incorporating offshore. Every location as well as jurisdiction is different, and it's hard to actually know the true effectiveness of an overseas business for your business.

If you're interested in considering Hong Kong as an option, contact us for more details and also among our professionals will certainly stroll you via Hong Kong as an offshore incorporation option (offshore business formation).

Discover the pros and also disadvantages of establishing up an offshore business, consisting of privacy as well as decreased tax liability, and also learn how to register, develop, or include your service outside of your country of house. In this write-up: Offshore business are services registered, developed, or integrated exterior of the country of house.

Things about Offshore Business Formation

If a lawful opponent is going after lawful action against you, it usually entails an asset search. This makes certain there is cash for repayments in case of a negative judgment versus you. Developing overseas companies as well as having assets held by the overseas company mean there is no longer a connection with your name.

The statutory obligations in the running of the overseas entity have actually also been streamlined. Due to the lack of public registers, verifying possession of a firm registered offshore can be difficult.

One of the major downsides is in the area of remittance and distribution of the properties and revenue of the overseas firm. get redirected here Reward income obtained by a Belgian holding company from a company based elsewhere (where revenue from foreign sources click to read is not strained) will certainly pay business income tax obligation at the regular Belgian rate.

The Offshore Business Formation Statements

In Spain, keeping tax of 21% is payable on passion and also dividend settlements, whether domestic or to non-treaty countries. Where rewards are paid to a firm that has share capital that has been held throughout the previous year equal to or above 5% keeping tax does not use. This means that tax obligation is deducted before cash can be paid or transferred to an offshore company.

The primary drive of the legislation is in requiring such business to demonstrate beyond a sensible question that their underlying activities are truly accomplished in their respective offshore center and also that these are certainly regular service tasks. There are large tax obligation risks with carrying out non-Swiss corporations from exterior of Switzerland.

An additional consideration is that of reputational danger - offshore business formation.

Offshore Business Formation for Beginners

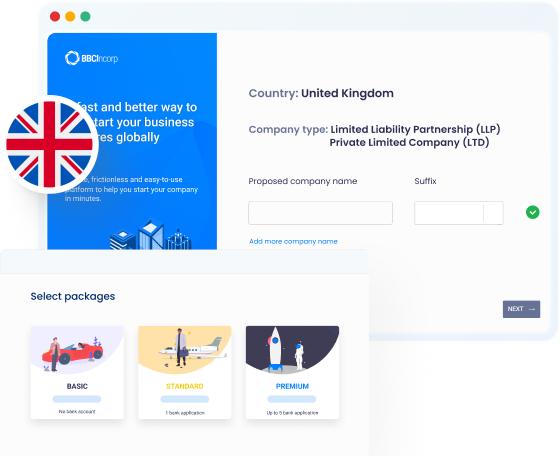

So the overseas business enrollment procedure have to be embarked on in total guidance of a business like us. The demand of going for offshore firm registration process is essential before establishing a firm. As it is called for to accomplish all the conditions then one have to describe an appropriate organization.

Take advantage of no tax obligations, audit as well as auditing, and a completely transparent, reduced financial investment venture. When selecting a procedure that requires appropriate focus while the fulfillment of guidelines and policies after that it is needed to comply with particular actions like the solutions webpage provided in Offshore Company Formation. For more details, please total our as well as an agent will touch in due training course.

India, China, the Philippines, Poland, Hungary, Ukraine, Brazil, Argentina, Egypt, and also South Africa are a few of the finest nations for offshore development.

The Basic Principles Of Offshore Business Formation

There are many factors why business owners may be interested in establishing up an offshore company: Tax obligation advantages, low conformity costs, a supportive financial atmosphere, and brand-new trade opportunities are several of the most commonly pointed out reasons for doing so. Below we check out what entrepreneurs require to do if they wish to establish a Hong Kong overseas company (offshore business formation).

This is due to the fact that: There is no demand for the firm to have Hong Kong resident directors (a common demand in various other countries) as Hong Kong adopts a policy that prefers overseas companies established by international financiers. offshore business formation. There is no need for the company to have Hong Kong resident investors either (a common demand in other places) foreign business owners do not require to partner with a regional homeowner to process a Hong Kong business configuration.